EMI Calculator

Yes, the stocIQ EMI Calculator can be used for calculating EMIs for home loans, car loans, personal loans, education loans, and more.

In a reducing balance method, the interest is calculated on the remaining principal amount after each EMI payment, whereas, in a flat rate method, the interest is calculated on the entire principal amount throughout the loan tenure.

You can reduce your EMI amount by opting for a longer tenure, negotiating for a lower interest rate, or making a higher down payment.

Prepayment of a loan reduces the outstanding principal amount, which in turn lowers the overall interest burden. This can either reduce the EMI for the remaining tenure or shorten the loan tenure while keeping the EMI the same. Use our EMI Calculator to compare the benefits of prepayment options.

Yes, you can use the EMI Calculator to calculate EMIs for loans with both fixed and floating interest rates. For floating rates, remember that the interest rate may change periodically, which will affect your EMI calculations.

Yes, there are tax benefits on EMI payments for certain types of loans. For instance, under Section 80C and Section 24 of the Income Tax Act, home loan borrowers can claim deductions on the principal and interest portions of their EMIs. Consult a tax advisor for detailed information specific to your case.

EMI Calculator for Loans

Calculate Your EMI Instantly with stocIQ’s EMI Calculator

Understanding your monthly loan obligations is crucial when planning to take out a loan, whether for a home, car, or personal needs. With stocIQ’s easy-to-use EMI Calculator, you can quickly calculate your Equated Monthly Installment (EMI) to make informed financial decisions.

What is EMI?

EMI (Equated Monthly Installment) is the fixed amount you pay every month to the lender until the loan is fully paid off. It includes both the principal amount and the interest on the loan. Calculating your EMI in advance helps you manage your finances better, ensuring you can comfortably repay the loan without straining your budget.

How to Use the EMI Calculator?

Using our EMI Calculator is simple. Just follow these three steps:

- Enter the Loan Amount (Rs): This is the total amount of money you wish to borrow.

- Enter the Annual Interest Rate (%): This is the interest rate that the lender will charge you annually.

- Enter the Loan Tenure (Years): This is the period over which you intend to repay the loan.

Once you input these values, click on the “Calculate EMI” button. The EMI Calculator will instantly display your monthly EMI amount, the total interest payable, and the total amount payable over the loan tenure.

Benefits of Using stocIQ’s EMI Calculator

- Accurate EMI Calculation: Get precise EMI amounts within seconds, helping you plan your finances effectively.

- Compare Loan Options: Use the calculator to compare different loan amounts, interest rates, and tenures to find the best loan option for your needs.

- Save Time and Effort: Avoid manual calculations and complex formulas. Our EMI Calculator does the work for you.

- User-Friendly Interface: Simple and intuitive design ensures anyone can use it without any hassle.

How is EMI Calculated?

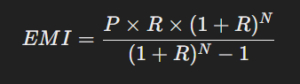

The formula used to calculate EMI is:

Where:

- P = Principal Loan Amount

- R = Monthly Interest Rate (Annual Interest Rate divided by 12 and then by 100)

- N = Loan Tenure in Months (Years multiplied by 12)

Our calculator applies this formula to compute the EMI instantly, so you don’t have to worry about the math.

Factors Affecting Your EMI

- Loan Amount: Higher loan amounts result in higher EMIs.

- Interest Rate: A higher interest rate increases the EMI, and vice versa.

- Loan Tenure: A longer loan tenure reduces the EMI amount, but you end up paying more interest over time.

Why Choose stocIQ for Your Financial Needs?

stocIQ is dedicated to providing the best financial tools and resources to help you make informed decisions. Our EMI Calculator is one of many tools designed to simplify complex financial calculations. Explore our website for more calculators and financial insights, such as the SIP Calculator and Lumpsum Calculator.

Start Calculating Your EMI Today!

Don’t let loan calculations stress you out. Use stocIQ’s EMI Calculator to plan your finances better and ensure a smooth loan repayment journey. Start now and make informed financial decisions with confidence!